Economic Scorecard – Analytics

Data Updated as of 1/2025

Economic Scorecard

Our funding model and metrics are similar to regular real world museums. However, MEROE museum is funded by donations, gift shop sales & private stakeholders.

If there are any questions regarding operations, funding, communications, and donations please contact [email protected]

FY 23 Score Card

MEROE Museum leverages several KPIs to monitor our progress.

DOnations

Donations include Events, Campaigns, Giftshop and Visitor Donations.

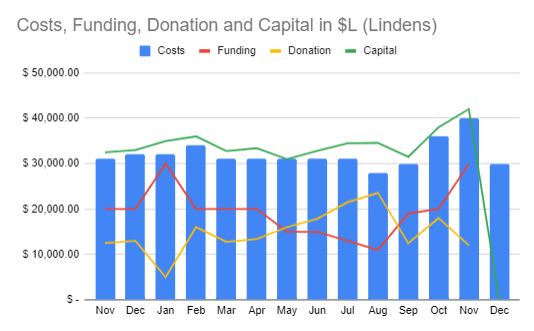

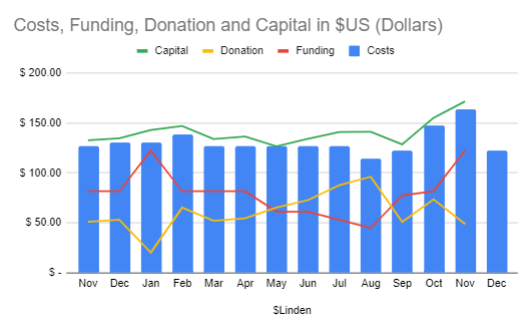

Data driven analytics provides clarity into donations/costs trends

Donations come from the events, and campaigns hosted by the museum through the year. Visitor donations fluctuate based on events, promotions and seasons. FY23 will feature the release of MEROE’s first products. We are increasing our budget by 25 % for promotions and events. Development of products, relocation and new exhibits increased our costs in Nov.

Our costs remained relatively flat over the year as collaborations and volunteers removed the need for payment for events, and promotions.

costs

MEROE Costs are controlled by using agile project/program methods.

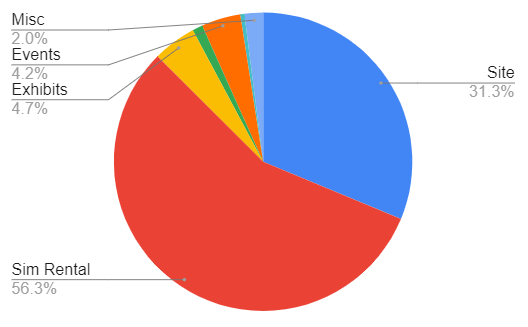

Costs for land, and Site remain steady. Increasing our promotions and exhibit budget for FY24

The model illustrates the majority of our costs are to maintain our presence on the internet and land within the metaverse. Since these costs are overall fixed, funding for these costs are predictable into the near future (± 15%).

Exhibits, promotions and events represent less than 50% of costs.

Join us! Subscribe & help make a difference, only takes a minute

Museum Business Model

Our funding model and metrics are similar to regular real world museums. However, MEROE museum is fully funded by private stakeholders. Each month there is a “true up” session regarding costs and funding.

The following article provides clarity into standard museum business models and related costs.

https://sothebysinstitute.com/news-and-events/news/the-business-model-of-the-nonprofit-museum/

Many people think of museums like Botticelli’s Venus, a perfectly formed entity that simply rises into being, already whole. And many people might think that the nonprofit status of museums means that there is not a commercial side essential to their creation or growth.

However, the origin story of museums in the United States is fundamentally one of business. American museums do not have a tradition of starting from royal collections like many of those in Europe, nor are they supported by socialist government financing, as is frequently the case in other countries.

American museums have always sprung from and maintained commercial activity, even though they are considered nonprofits and are often perceived to be apart from the business world. But in actuality, without the business world, they wouldn’t exist. The idea that art and money operate in separate universes is something that Sotheby’s Institute is here to dissolve, especially through our MA in Art Business programs.

So, here’s what to know about the business behind “nonprofit” museums.

What is a 501(c)3?

Mostly pertaining to public charities and private foundations, a 501(c)3 company is defined by (and named for) its tax status: the organization does not have to pay corporate income tax on its revenue. We frequently call these “nonprofits.” But it’s important to keep in mind that “nonprofit” is a tax status, not a business plan, and that making a profit is fundamental to the health of art organizations.

A 501(c)3 can make a profit “so long as it does so by carrying on an activity related to its exempt purposes,” according to IRS policy. These profits can only be used to pay reasonable compensation and necessary expenses as related to its mission. What governs the profit of a nonprofit, so to speak, is what they do with it; not that they don’t make it.

What are the three elements of nonprofit revenue?

In the nonprofit world of museums, there are three main categories of revenue:

Contributions, or fundraising, which typically counts for over half of a museums’ revenue at an industry standard of around 60%.

Program services, such as admissions, is not insignificant, but is proportionally small. For example, 2% of the Metropolitan Museum of Art’s revenue is from ticket sales.

Earned income typically accounts for 40% of a museums’ revenue. A relatively new and increasing category, this can encompass everything from merchandise and licensing to gift shops and educational programs. While these might seem standard to the museum experience today, they represent relatively new and disruptive developments to the museum business model of the past.

Where does the money come from?

Museums, among other nonprofits, employ a wide spread of tactics to bring in income. Galas, for example, are known as high-profile fundraising events and occupy a large part of press and public attention. But galas are not as strong for revenue as they are for community building and cultivating the goodwill of board members and donors. There’s usually a net of $0.40 for every dollar spent, and that’s before factoring in the significant staff time to plan and execute these notable events.

Museum shops can be profitable, but in most instances only break-even. Cafes are marginally profitable, but are primarily a service that’s de rigeur to offer visitors—an expected part of the museum experience. Educational programs are good sources of earned income, if done well. Merchandising and licensing can be significant, based on the blockbuster works an institution might own or the recognizability of its brand. Corporate sponsorship can play a large role as well, depending on the mission and policies of the museum. And space rental for events, like weddings, are often more problematic than profitable, as the audience is not there for the art but to use the facility as a scenic backdrop. The wear and tear on the staff and facilities around events—without the added benefit of cultivating art lovers and repeat visitors—makes this a losing proposition for many museums.

Fundraising—that core income source that is around 60% of a healthy museum’s revenue—might receive high visibility when compelling participation stories are involved. #GivingTuesday is one such example. Yet in reality, it is the few and repeat donors that truly drive this revenue engine for museums, not the annual fund, direct mail, crowdfunding, or small gifts. The 80/20 rule applies to fundraising, with 80% of gifts usually coming from 20% of donors. In 2017, this was even more pronounced in the case study of the Met, where 88% of gifts come from only 12% of donors. A solid recommendation for museum fundraisers is to concentrate on the committed and long-standing donors, rather than over indexing staff’s time and energy on new donor acquisition. With donor retention falling by 12% since 2008, focusing on retention means a reliable revenue stream in an organization. The revenue emphasis around the few yet generous donors also means that major gift officers are usually among the highest paid jobs in the organization.

How liquid are nonprofit museums?

Museums, especially the large and well-funded ones, can have an impressive bottom line going into many millions of dollars. Looking at the Met case study, their listed assets are almost $4 billion. However, liquidity of these art institutions—big and small—is much more limited. In the same Met example, cash holdings are only $7 million. Museums should, as a best practice, have 90 days of liquidity at any given time.

Fixed land holdings can contribute to impressive bottom lines, especially in major metropolitan areas. However, land and facilities can provide a false positive when looking at a museum’s spendable cash. For example, many museums don’t own their land or the impressive buildings, but rather maintain the rights to use it from the city or state. Additionally, most hold charters that stipulate if the institution ceases to exist, the land and building revert back to the city—the museum can’t sell it.

From the three revenue areas listed above, donations can go into the liquid assets of a museum, but only if they are unrestricted gifts. These can be used for operating costs such as lighting and heating, which are potentially exorbitant costs, especially in grand old buildings. Purchasing of inventory is another acceptable use of liquid resources. Restricted gifts, when donations or grant funds are earmarked as project-based (temporary restrictions) or endowment (permanently restricted) can represent a large portion of a museum’s holdings; but they can’t be liquified. (It is, however, a not-so-secret secret that institutions can borrow funds from their temporary restricted accounts to pay operating expenses. It’s not a recommended practice, but it does happen.)

What are the takeaways?

American museums are unlike, say, the Louvre. Arguably the most famous museum in the world, the Louvre is miraculously funded by the French state and supplemented by other revenue streams from donations to licensing (the newly opened Louvre Abu Dhabi is a notable example). In comparison, nonprofit museums in the United States came to exist through the civic-minded philanthropy and commercial acumen of bankers and financiers precisely because there was no government support.

With unknown tax policy changes on the horizon, the earned income of admissions, gift shops, licensing, and other revenue streams will become more important than ever, as projections indicate that the 30% of the U.S. population who donate might drop to a mere 8%.

Without margin, there is no mission. Staying profitable is the only way for a museum to keep its mission alive, given high operating costs and limited liquidity. With the 501(c)3 tax status sheltering museums from taxable income, using their revenue in support of the museum’s mission is not only a guiding principle, but a requirement of the business model.

This article is based on lectures by Jenny Gibbs, former Program Director of MA Art Business in New York

At this time 100 % of all donations are added to the UHURU Program project which automatically routes the donations to selected STEM (Science, Technology, Engineering, and Math) non profit organizations.

If there are any questions regarding operations, funding, communications, and donations please contact [email protected]